TOLL ROADS

|

|

Dec-16 |

Dec-15 |

Var. |

Like-for-Like |

|

Revenues |

486 |

513 |

-5.3% |

24.8% |

|

EBITDA |

297 |

333 |

-10.8% |

24.9% |

|

EBITDA Margin |

61.1% |

64.9% |

|

|

|

EBIT |

214 |

250 |

-14.4% |

16.8% |

|

EBIT Margin |

44.0% |

48.7% |

|

|

Revenues at the Toll Roads division expanded +24.8% in comparable terms vs. year-end 2015, impacted by the strong growth on the managed lanes toll roads in the USA and by traffic growth for the majority of assets. Of particular note is the growth of the LBJ toll road (managed lanes), which opened in its final configuration in September 2015, and which only contributed partial sections in the first nine months of 2015. In comparable terms, the division also posted strong EBITDA growth (+24.9%).

The comparable figures strip out the FX effect and the impact of the changes in the consolidation perimeter during the 2016. Notably the changes for the disposals of:

- Chicago Skyway: Sale to a consortium of Canadian pension funds of Cintra’s 55% stake in this asset, for EUR230mn. The deal was closed in February 2016, such that it contributed for just two months in 2016 vs. the whole of 2015.

- Irish toll roads: sale of a 46% stake in M4 and 75% of M3 to the Dutch fund DIF for EUR59mn. Ferrovial retains a 20% stake in each asset. The deal was closed in February 2016, such that they contributed to EBITDA for just two months in 2016 vs. the whole of 2015.

In June 2016, Ferrovial reached an agreement to sell a stake in the Norte Litoral and Algarve toll roads. Both toll roads have been reclassified as assets held for sale, and their debt has thus been reclassified as liabilities held for sale (EUR323mn as of December 2016), although they continue to contribute to Ferrovial’s P&L (global consolidation) until the deal is completed.

ASSETS IN OPERATION

Traffic performance

Traffic performance during 2016 was very positive on the majority of the Group’s motorways, with good performance from both light and heavy traffic. The main supporting factors of this trend have been the economic recovery observed since the second half of 2014 (in the USA, Canada, Spain, Portugal and Ireland), the calendar effect (2016 was a leap year), and to a lesser extent the low price of oil.

By country:

In Canada traffic on the 407ETR increased by +4.9% in the year, both in terms of light (+5.0%), as well as heavy traffic (+4.2%), bolstered by the stronger economic growth in the Ontario region, the low oil price and the positive impact of the opening of 407 East Extension Phase I toll road.

In the USA, traffic growth was driven by the positive performance of the managed lanes toll roads (in their ramp-up phase) and the strong US economic performance.

In Spain, significant traffic growth at Autema and Ausol I and II, which ended the year with growth of approximately +10%. Economic growth, the upturn in employment and the strength of tourism in Spain have helped to drive a recovery in traffic on all of the Spanish concessions.

The Portuguese concessions performed positively this year, helped by the recovery in the economy. The road works on the alternative route since the end of 2015 favoured the traffic on the Algarve, and traffic rose +16.5% (since December 2015 this toll road has been classified as a financial asset, with retroactive effect since January of that year). On the Azores toll road, in spite of the impact of a storm at the beginning of the year, traffic performance has been very positive and the asset closed the year with traffic growth of +7.2%, supported by the increase of tourism on the back of the airline market liberalisation.

In Ireland, traffic performance continues to perform well for the fourth year running, reflecting the continuing improvement in the Irish economy and, in particular, the levels of employment in the country.

From 1 March 2016, following the completion of the sale of stakes in both the M4 and the M3 toll roads in Ireland, these two assets have been consolidated by the equity method.

|

Global consolidation |

Traffic (ADT) |

Revenues |

EBITDA |

EBITDA Margin |

Net Debt 100% |

||||||||||

|

€ million |

Dec-16 |

Dec-15 |

Var. |

Dec-16 |

Dec-15 |

Var. |

Dec-16 |

Dec-15 |

Var. |

Dec-16 |

Dec-15 |

Dec-16 |

Share |

||

|

|||||||||||||||

|

Intangible assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

NTE |

30,485 |

25,553 |

19.3% |

67 |

47 |

41.2% |

51 |

34 |

49.5% |

77.2% |

72.9% |

-979 |

57% |

||

|

LBJ* |

31,582 |

12,861 |

145.6% |

69 |

20 |

245.5% |

53 |

10 |

n.s. |

77.0% |

50.7% |

-1,374 |

51% |

||

|

Ausol I |

14,637 |

13,165 |

11.2% |

56 |

51 |

10.0% |

47 |

41 |

15.2% |

82.8% |

79.1% |

-490 |

80% |

||

|

Ausol II |

16,837 |

15,402 |

9.3% |

|

|

|

|

|

|

|

|

|

|

||

|

Azores |

9,215 |

8,596 |

7.2% |

32 |

23 |

39.1% |

28 |

18 |

50.1% |

87.0% |

80.6% |

-319 |

89% |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Financial Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Autema |

|

|

|

98 |

88 |

10.9% |

89 |

79 |

12.1% |

90.9% |

89.9% |

-627 |

76% |

||

|

Norte Litoral |

|

|

|

44 |

45 |

-1.3% |

38 |

39 |

-1.4% |

86.3% |

86.4% |

-180 |

100% |

||

|

Algarve |

|

|

|

38 |

35 |

5.8% |

33 |

30 |

8.7% |

87.6% |

85.3% |

-143 |

97% |

||

|

Via Livre |

|

|

|

14 |

14 |

-4.0% |

2 |

1 |

24.3% |

13.6% |

10.5% |

3 |

84% |

||

|

Equity accounted |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Intangible assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

407 ETR (VKT'000) |

2,640,770 |

2,517,214 |

4.9% |

778 |

704 |

10.5% |

675 |

590 |

14.4% |

86.8% |

83.8% |

-4,688 |

43% |

||

|

M4 |

30,377 |

28,512 |

6.5% |

27 |

25 |

7.3% |

18 |

17 |

2.6% |

65.7% |

68.8% |

-102 |

20% |

||

|

Central Greece |

12,151 |

13,521 |

-10.1% |

50 |

11 |

n.s. |

43 |

4 |

n.s. |

86.1% |

35.7% |

-341 |

21% |

||

|

Ionian Roads |

24,979 |

24,236 |

3.1% |

77 |

75 |

2.4% |

15 |

47 |

-68.7% |

19.2% |

62.9% |

-18 |

21% |

||

|

Serrano Park |

|

|

|

5 |

5 |

0.4% |

3 |

3 |

13.1% |

59.7% |

53.0% |

-42 |

50% |

||

|

Financial Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

M3 |

|

|

|

22 |

23 |

-5.2% |

17 |

18 |

-5.6% |

75.4% |

75.7% |

-166 |

20% |

||

|

A-66 Benavente Zamora |

|

|

|

24 |

49 |

-51.7% |

22 |

20 |

7.5% |

91.4% |

41.0% |

-163 |

25% |

||

407ETR

Profit and loss account

|

CAD million |

Dec-16 |

Dec-15 |

Var. |

||

|

|||||

|

Revenues |

1,135 |

1,002 |

13.2% |

||

|

EBITDA |

985 |

840 |

17.3% |

||

|

EBITDA Margin |

86.8% |

83.8% |

|

||

|

EBIT |

880 |

754 |

16.7% |

||

|

EBIT Margin |

77.6% |

75.2% |

|

||

|

Financial results |

-373 |

-327 |

-14.0% |

||

|

EBT |

507 |

427 |

18.8% |

||

|

Corporate income tax |

-134 |

-116 |

-16.0% |

||

|

Net Income |

373 |

311 |

19.9% |

||

|

Contribution to Ferrovial |

|

|

|

||

|

equity accounted result (EUR mn) |

98 |

82 |

19.6% |

||

Revenues at 407ETR increased by +13.2% in local currency in 2016 vs. 2015.

- Toll revenues (93% of the total): grew by +15.3% to CAD1,056mn, mainly due to the tariff increases applied since February 2016 and the improvement in traffic.

- Fee revenues (6% of the total): up by +2.9% to CAD68mn, mainly as a reflection of more transponders and higher tariffs.

- Average revenues per journey rose +11.4%.

- Contract Revenues (1% of total), for works carried out for the East Extension Phase I: fell from CAD20mn in 2015 to CAD11mn in 2016 as more work was executed in 2015 than in 2016, due to the construction phase being completed on 20 June 2016.

The toll road also recorded an increase in EBITDA of +17.3% in 2016, improving its EBITDA margin from 83.8% to 86.8%.

Financial result: -CAD373mn, 46mn of more expenses vs 2015 (-14%). Main components:

- Interest expenses: -CAD350mn. CAD14mn higher than in 2015 due to the increase in debt, after the recent issuance of CAD500mn senior bonds in May 2016, the issuance of CAD350mn in November 2016 and CAD150mn in March 2015 and higher drawdowns on the lines of credit.

- Non-cash inflation-linked financial expenses: -CAD34mn. An increase of CAD33mn vs. 2015, due to a negative impact of the fair value of bonds and higher inflation.

- Financial income: +CAD11mn (vs. +CAD9mn in 2015) due to greater returns on investment and higher average cash balance.

407ETR contributed EUR98mn to Ferrovial’s equity-accounted results (+19.6% vs. 2015), after the annual amortization of the goodwill following the sale of 10% in 2010, which is being written down over the life of the asset on the basis of the traffic forecast.

Dividends 407ETR

In 2016, 407ETR distributed dividends of CAD790mn, +5.3% vs. 2015. Of these, EUR244mn were distributed to Ferrovial (EUR242mn in 2015). The 1Q17 dividend payment was approved in February 2017 in the amount of CAD207.5mn (+10.7% vs. 1Q16).

|

CAD million |

2017 |

2016 |

2015 |

2014 |

2013 |

2012 |

|

Q1 |

207,5 |

187,5 |

188 |

175 |

100 |

87,5 |

|

Q2 |

|

187,5 |

188 |

175 |

130 |

87,5 |

|

Q3 |

|

207,5 |

188 |

175 |

200 |

87,5 |

|

Q4 |

|

207,5 |

188 |

205 |

250 |

337,5 |

|

Total |

|

790 |

750 |

730 |

680 |

600 |

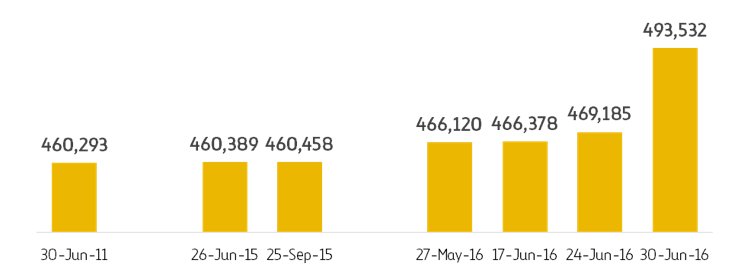

407ETR Traffic

Traffic (kilometres travelled) rose +4.9% (+7.1% in 3Q16 alone and +6.3% in 4Q16), with an increase in the number of journeys (+2.7%) and an increase in the average distance travelled (+2.2%). Traffic was affected by the economic growth, the low price of oil and the opening of the 407 East Extension Phase I toll road, which opened to the public on 20 June, and which was toll-free in 2016 (began to charge in February 2017).

The toll road recorded four record days of daily journeys in 2016, three of which were in June.

Daily trips

407ETR net debt

The net debt figure for 407ETR at 31 December 2016 was CAD6,650mn, at an average cost of 4.51%. There were two bond issues in 2016: on 4 November, in the amount of CAD350mn, maturing in May 2027 with a coupon of 2.43% (series 16-A2), and on 16 May, in the amount of CAD500mn (series 16-A1), a 31-year bond maturing in May 2047 offering an interest rate of 3.6%.

38% of the debt matures in more than 20 years’ time. The next maturity dates will occur during 2017 (CAD313mn), 2018 (CAD14mn) and 2019 (CAD15mn).

407ETR credit rating

- S&P: In S&P ratings issued on 17 March 2016, the company remained at "A" (Senior Debt), "A-" (Junior Debt) and "BBB" (Subordinated Debt), with a stable outlook.

- DBRS: On 4 November 2016, the company remained at "A" (Senior Debt), "A low" (Junior Debt) and "BBB" (Subordinated Debt), with a stable outlook.

407ETR Tariffs

The table below shows a comparison between rates in 2015 and 2016 (valid from 1 February 2016) for light vehicles:

|

CAD |

2016 |

2015 |

|

Regular Zone |

|

|

|

AM Peak Period: Mon-Fri: 6am-7am, 9am-10am |

33.00¢ /km |

30.56¢ /km |

|

AM Peak Hours: Mon-Fri: 7am-9am |

37.54¢ /km |

34.13¢ /km |

|

PM Peak Period: Mon-Fri: 3pm-4pm, 6pm-7pm |

34.24¢ /km |

31.13¢ /km |

|

PM Peak Hours: Mon-Fri: 4pm-6pm |

38.90¢ /km |

34.73¢ /km |

|

Light Zone |

|

|

|

AM Peak Period: Mon-Fri: 6am-7am, 9am-10am |

31.37¢ /km |

29.05¢ /km |

|

AM Peak Hours: Mon-Fri: 7am-9am |

35.67¢ /km |

32.43¢ /km |

|

PM Peak Period: Mon-Fri: 3pm-4pm, 6pm-7pm |

32.55¢ /km |

29.59¢ /km |

|

PM Peak Hours: Mon-Fri: 4pm-6pm |

36.97¢ /km |

33.01¢ /km |

|

Midday Rate |

28.33¢/km |

25.75¢/km |

|

Weekdays 10am-3pm, Weekend & public holidays 11am-7pm |

25.95¢/km |

23.59¢/km |

|

Off Peak Rate |

|

|

|

Weekdays 7pm-6am, Weekend & public holidays 7pm-11am |

21.62¢/km |

19.74¢/km |

407-EAST EXTENSION I

- The toll road opened to traffic on 20 June 2016.

- 22km to the east of Brock Road in Pickering to Harmony Road in Oshawa (Ontario), and a connection, the 412 toll road, which joins the 407 and the 401, of approximately 10km.

- The 407 Extension I and Connection 412 are toll roads on which charges become effective from February 2017, following an initial free period. Tariffs are established by the province of Ontario, which will collect revenues according to an explicit tariff system.

- 407ETR, through its subsidiary Cantoll, assumed the management of the tolls in a services contract, with no traffic risk, such that the new sections will be integrated continuously and without interruptions with the 407ETR. Drivers will use a single transponder, will receive a single bill, and will have access to the same consumer assistance centre the whole length of the toll road.

- 407 Extension I will be responsible for maintenance, refurbishment and incident management.

- Ferrovial, through Cintra, owns a 50% stake in this concession (which is equity-accounted).

NTE

NTE Profit & loss account:

|

USD million |

Dec-16 |

Dec-15 |

Var. |

|

Revenues |

73 |

52 |

41.3% |

|

EBITDA |

57 |

38 |

49.5% |

|

EBITDA Margin |

77.2% |

72.9% |

|

|

EBIT |

40 |

23 |

71.3% |

|

EBIT Margin |

54.1% |

44.6% |

|

|

Financial results |

-61 |

-59 |

-3.2% |

|

EBT |

-21 |

-36 |

40.6% |

|

Corporate income tax |

|

|

|

|

Net Income |

-21 |

-36 |

40.6% |

Across the whole of 2016, revenues were +41.3% higher than in 2015, reaching USD73mn, due to traffic growth (+19%) and higher tariffs (+18%).

EBITDA reached USD57mn (+49.5% vs. 2015). The EBITDA margin rose +4.3% over the course of 2016, rising to close to 80% in the second full year of operation as the result of the robust growth in revenues and the management of operational costs.

NTE Quarterly Traffic and EBITDA

In terms of traffic: in 4Q2016, NTE recorded 6 million transactions, +5.1% more than in 4Q2015 (5.7 million transactions). Traffic continued to increase its market share of traffic on the corridor and maintaining a high percentage of new customers every month. In this fourth quarter, increased construction activity on projects located alongside the NTE have had a negative impact on traffic growth in comparison with the levels recorded in previous quarters.

NTE EBITDA was very positive, with growth of +39.4% in 4Q2016 vs. 4Q2015, reaching the highest quarterly figure for EBITDA since the toll road was opened, at USD15mn.

|

Quarterly results |

4Q'16 |

4Q'15 |

% var. |

|

Transactions (millions) |

6.0 |

5.7 |

5.1% |

|

EBITDA (USD mn) |

15.2 |

10.9 |

39.4% |

Since the dynamic tolling system came into operation in April 2015, the tariffs can be adjusted every five minutes, depending on the levels of congestion observed. As a result, at times of heavy congestion, the toll rates applied have reached the maximum permitted under the contract (USD0.84/mile). This maximum tariff can be surpassed when traffic volume in the managed lanes exceeds a certain amount or when the average speed in the managed lanes is lower than 50miles/hr.

The average toll rate per transaction in 2016 at NTE reached USD3.05 vs. USD2.58 in December 2015 (an increase of +18.2%).

NTE net debt

As of 31 December 2016, net debt for the toll road amounted to USD1,032mn (USD1,012mn in December 2015), at an average cost of 5.38%.

NTE credit rating

The agencies have assigned the following ratings to NTE’s debt:

|

|

PAB |

TIFIA |

|

Moody’s |

Baa3 |

|

|

FITCH |

BBB- |

BBB- |

LBJ

LBJ profit and loss account

|

USD million |

Dec-16 |

Dec-15 |

Var. |

||||

|

|||||||

|

Revenues |

76 |

22 |

247.3% |

||||

|

EBITDA |

59 |

11 |

424.8% |

||||

|

EBITDA Margin |

77.0% |

51.0% |

|

||||

|

EBIT |

39 |

5 |

678.5% |

||||

|

EBIT Margin |

51.0% |

22.8% |

|

||||

|

Financial results |

-85 |

-50 |

-70.3% |

||||

|

EBT |

-46 |

-45 |

-3.0% |

||||

|

Corporate income tax |

|

|

|

||||

|

Net Income |

-46 |

-45 |

-3.0% |

||||

The toll road, which has now been open slightly more than a year in its final configuration, reported revenues of USD76mn in 2016.

EBITDA reached USD59mn, mainly driven by the strong traffic growth since the project has been fully open. The EBITDA margin reached 77%, aided by the growth in revenues and the management of operational costs.

LBJ Quarterly Traffic and EBITDA

In terms of traffic: in 4Q 2016, traffic reached 10 million transactions, +45% vs. the fourth quarter of last year. This is the quarter year since the project was fully opened (September 2015) that we have comparable year-on-year data. Traffic along the corridor continues to show robust growth and is now reaching levels that are well above those recorded prior to the project’s construction; drivers are also becoming increasingly familiar with the project’s layout.

EBITDA in 4Q 2016 increased significantly vs. 4Q 2015, +129%:

|

Quarterly results |

4Q'16 |

4Q'15 |

% var. |

|

Transactions (millions) |

10.0 |

7.0 |

45.4% |

|

EBITDA (USD mn) |

16.2 |

7.1 |

129.4% |

Since the dynamic tolling system came into operation, the tariffs have been able to be adjusted every five minutes, depending on the levels of congestion observed. As a result, at times of heavy congestion, the toll rates applied have reached the maximum permitted under the contract (USD 0.84/mile during 2016). This maximum tariff can be surpassed when traffic volume in the managed lanes exceeds a certain amount or when the average speed in the managed lanes is lower than 50miles/hr.

The average toll rate per transaction at LBJ reached USD2.11 in 4Q16 vs. USD1.66 in 4Q15 (an increase of +27.1%).

LBJ Net debt

As of 31 December 2016, net debt for the toll road amounted to USD1,449 (USD1,409mn in December 2015), at an average debt cost of 5.48%.

LBJ credit rating

The agencies have given the following credit ratings to LBJ’s debt:

|

|

PAB |

TIFIA |

|

Moody’s |

Baa3 |

|

|

FITCH |

BBB- |

BBB- |

FINANCIAL ASSETS

Under the terms of IFRIC 12, concession contracts may be classified in one of two ways: intangible assets or financial assets.

Intangible assets (where the operator assumes the traffic risk) are those for which remuneration is earned from the right to charge the corresponding rates depending on level of use.

Financial assets are concession agreements in which payment consists of an unconditional contractual right to receive cash or other financial assets, either because the body awarding the concession guarantees the payment of specific sums, or because it guarantees the recovery of any shortfall between the sums received from users of the public service and the aforementioned specific sums. In this type of concession agreement, the demand risk is therefore assumed by the body awarding the concession.

The assets in operation classified as financial assets, which bear no traffic risk due to some kind of guarantee mechanism are Norte Litoral, Autema, Via Livre, A66, Algarve and Eurolink M3 (the latter is equity-accounted). Algarve was classified as a financial asset in December 2015 after an agreement with the Portuguese government under which the concession changed to being a contract for availability (with no traffic risk).

ASSETS UNDER DEVELOPMENT

Assets under construction

|

€ million |

Invested Capital |

Pending committed capital |

Net Debt 100% |

Share |

|

Global Consolidation |

|

|

|

|

|

Intangible Assets |

-128 |

187 |

-641 |

|

|

NTE 35W |

-127 |

70 |

-507 |

54% |

|

I-77 |

-1 |

117 |

-134 |

50% |

|

Equity Consolidated |

|

|

|

|

|

Financial Assets |

-46 |

87 |

-619 |

|

|

407-East Extension II |

|

11 |

-215 |

50% |

|

M8 |

-3 |

6 |

-387 |

20% |

|

Ruta del Cacao |

-32 |

30 |

49 |

40% |

|

Toowoomba |

-11 |

|

63 |

40% |

|

Bratislava |

|

40 |

-128 |

45% |

NTE 35W: The project reached financial close in September 2013 and work is proceeding on schedule (72% completed at December 2016), with opening scheduled for mid 2018.

I-77: Construction work began in November 2015. In December 2016 the design and construction works were 24% complete, and the toll road is expected to open at the end of 2018.

407 East Extension Phase II: At end-December 2016, the design and construction works were 43% complete.

PROJECT REFINANCING

Ausol

In March 2016, Cintra closed the refinancing of the two sections of its Autopista del Sol toll road (Ausol I and Ausol II) in Andalusia (Spain). The new financial structure totals EUR558mn (with no recourse to the shareholders) and has allowed financial expenses to be reduced and maturities to be extended to 2045.

The structure comprises two tranches:

- Issuance of bonds and obligations (EUR507mn, fixed coupon of 3.75%, 30-year maturity), rated "BBB", with Stable outlook by S&P.

- Subordinated bank debt (EUR51mn, at a fixed cost of 7% and a 10-year maturity extendable to 30 years).

TENDERS PENDING

Promotional activity is continuously monitored in Ferrovial’s international target markets (North America, Europe and Australia).

The consortium including Cintra and Ferrovial Agroman has been pre-qualified for the Melbourne Metro Rail project (Australia). This relates to a contract for the design, construction, financing and maintenance of 9 km of double tunnel and five underground stations.

In Canada, Cintra submitted its pre-qualification application for the “Hurontario” project, which consists of the construction and operation of 20 km of light railway in Toronto (Ontario) under a system of availability payment.

TENDER AWARDS

I-66 Toll Road

In October 2016, Cintra was awarded the "Transform I-66 Project" (Virginia, USA), the commercial close took place on 8 December 2016.

This is a managed lanes type concession project with dynamic tolling, located to the west of the American capital, Washington D.C. The consortium comprises Cintra together with the Meridiam infrastructure fund, which will be responsible for the design, construction, financing, operation and maintenance of the Transform I-66 Project, for a value of more than EUR3,000mn.

The project includes the construction of 35 km along the I-66 corridor between Route 29, close to Gainesville, and the Washington DC ring road, the I-495, in Fairfax County.

The term allocated for construction of the project runs until 2022, while the concession is granted for 50 years.

With the financing still pending completion (which is forecast for the second half of 2017), the committed capital for this project is estimated at EUR723mn (for Cintra’s stake).

COMPLETED FINANCING

On 20 June the financing of the D4-R7 Bratislava beltway (Slovakia) project was closed. The project includes the design, construction, financing, operation and maintenance of the Bratislava beltway, for a total of EUR975mn. The consortium also includes the Australian group Macquarie and the Austrian construction company Porr. Cintra will be responsible for the development of this project (availability payment), whose design and construction will be carried out by the JV led by Ferrovial Agroman.

PROJECT DIVESTMENTS

M3 and M4 Toll roads

In September 2015, Ferrovial, through its Toll Motorway division Cintra, reached an agreement with the Dutch infrastructure fund DIF to sell 46% of the M4 toll road and 75% of the M3 toll road for EUR59mn (implying a net capital gain of EUR21mn).

The deal was closed in February 2016, since when the assets have no longer been classified as "Assets Held for Sale". As a result of this deal, Ferrovial became the 20% owner of both concessions, remaining as a core industrial shareholder.

Chicago Skyway Toll Road

In November 2015, Ferrovial, through Cintra, reached an agreement with the Calumet Concession Partners LLC consortium (formed by the Canadian pension funds OMERS, Canada Pension Plan Investment Board and Ontario Teachers’ Pension Plan) for the transfer of 100% of the Chicago Skyway toll road (55% belonging to Ferrovial and 45% to Macquarie Atlas Roads and Macquarie Infrastructure Partners).

The deal was closed on 25 February 2016, since when the asset has no longer been classified as "Assets Held for Sale".

The price agreed was USD2,836mn (approximately EUR2,623mn), or EUR230mn in cash for Ferrovial and a net capital gain of EUR103mn.

Norte Litoral & Algarve Toll Roads

In June 2016, Ferrovial, through its toll roads subsidiary Cintra, reached an agreement with the Dutch infrastructure fund DIF to sell 51% of the Norte Litoral and 49% of the Algarve toll roads for a total of EUR159mn. After this transaction, which is pending administrative approval, Ferrovial will continue to hold 49% of the Norte Litoral and 48% of the Algarve, as well as its position as the principal industrial partner in both assets. Completion of this operation remains pending administrative approval.

OTHER EVENTS

Autema

On 16 July 2015, the official journal of the regional government of Catalonia (Boletín Oficial de la Generalitat de Cataluña) published Decree 161/2015, which unilaterally approved the modification of the administrative concession of the Tarrasa-Manresa toll road.

On 9 October 2015, the Company filed an appeal against this new Decree with the High Court of Justice in Catalonia (TSJC), which was admitted for process on 13 October 2015. The new tariffs (discounts) applicable under the new decree have been applied since 4 January 2016.

On 2 January 2017, a new Decree came into force, extending the existing discounts and delaying the removal of the discount applied in working days (45%), to those users that do not use VIA-T from 2017 to 2019.

ASSETS IN INSOLVENCY PROCEEDINGS

SH-130

On 31 December 2016, the SH-130 concession company was deconsolidated, as control over the business was considered to have been lost. Deconsolidation has had a positive effect on Ferrovial’s net result after tax in the amount of EUR30mn (reversal of accumulated losses) and meant the removal of net debt from the balance sheet of EUR1,421mn.

On 2 March 2016, the concession company that manages the SH-130 toll road requested court protection against its creditors (Chapter 11). In the end a plan was agreed with the banks and TIFIA to transfer its assets and exit from the Chapter 11 process.