SECTION 5: CAPITAL STRUCTURE AND FINANCING

The Notes in this section describe the changes in the financial structure of Ferrovial as a result of changes in equity (see Note 5.1) and in its consolidated net debt (see Note 5.2), taken to be the balance of cash and cash equivalents net of the financial debt, bank borrowings and debt securities, making a distinction between non-infrastructure project companies and infrastructure projects. They also describe the Group’s exposure to the main financial risks and the policies for managing them (see Note 5.4), as well as the derivatives arranged in connection with those policies (see Note 5.5).

The equity attributable to the shareholders (see Note 5.1) decreased with respect to 2016, due to the impact of the early application of IFRS 15 (discussed in Note 1.3.1), the expense recognised directly in equity (arising from the exchange rate effect, pensions and derivatives) and to shareholder remuneration, which was offset in part by the increase in the consolidated net profit and the subordinated hybrid bond issue.

EQUITY ATTRIBUTABLE TO THE SHAREHOLDERS |

|

Beginning balance at 01/01/17 |

5,597 |

Transition to IFRS 15 |

-272 |

Net profit |

454 |

Income and expense recognised directly in equity |

-191 |

Transfers to profit or loss |

6 |

Shareholder remuneration |

-520 |

Subordinated hybrid bond issue |

495 |

Other |

-66 |

Ending balance at 31/12/17 |

5,503 |

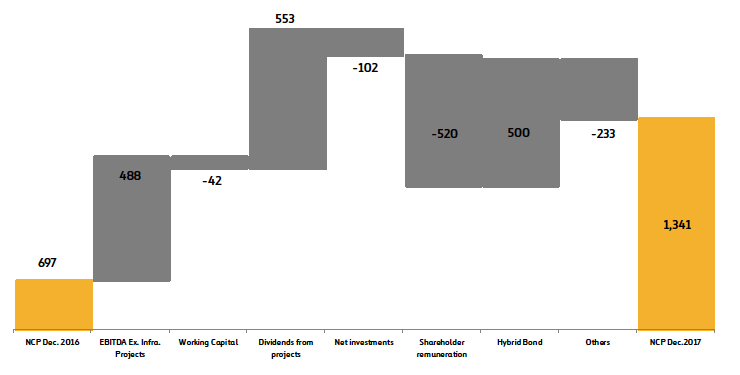

At 31 December 2015, the consolidated net debt of Ferrovial’s non-infrastructure project companies was a positive net cash position of EUR 1,341 million, higher than that at December 2016 (EUR 697 million). This amount includes the cash obtained through the subordinated hybrid bond issue, which is treated as an equity instrument. Excluding this effect, mention should be made of the positive cash flows from activity generated in the year (EUR 896 million), offset by the payment of dividends (EUR -520 million). The other changes are analysed through cash flows (see Note 5.3) and the directors’ report.

NET CASH POSITION NON-INFRASTRUCTURE PROJECT COMPANIES:

Enlarge image

The consolidated net debt continues to make it possible to amply achieve the objective of maintaining an investment grade rating, where the Company considers a relevant metric a ratio, for non-infrastructure projects, of net debt (gross debt less cash) to gross profit from operations (EBITDA) plus dividends from projects of no more than 2:1. Ferrovial’s rating remains unchanged at BBB.

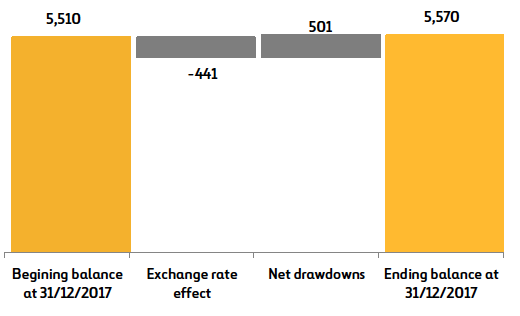

The borrowings of infrastructure projects remained at similar levels to those of 2016 (EUR 5,570 million in December 2017 compared to EUR 5,510 million in December 2016), most noteworthy being the impact of the net drawdowns (EUR 501 million), partially offset by the positive exchange rate effect (EUR 441 million), due mainly to the increase in value of the US dollar.

BORROWINGS OF INFRASTRUCTURE PROJECTS: