SECTION 3: NON-CURRENT ASSETS

This section includes the Notes on non-current assets in the consolidated statement of financial position, excluding deferred tax assets (Section 2) and financial derivatives (Section 5).

The main components of the non-current assets at 31 December 2017 at Ferrovial are “Investments in Infrastructure Projects” amounting to EUR 6,917 million, accounting for 46% of total non-current assets (see Note 3.3), “Investments in Associates” amounting to EUR 2,687 million (relating mainly to the investments in HAH and 407 ETR), accounting for 18% of total non-current assets (see Note 3.5), and “Goodwill Arising on Consolidation” (EUR 2,062 million), which represents 14% of total non-current assets.

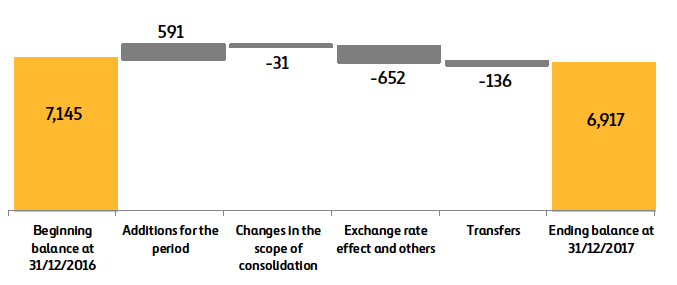

The decrease in investments in infrastructure projects with respect to 2016 was due mainly to the exchange rate effect (fall in the value of the US dollar), with an impact of EUR -652 million, partially offset by the non-current asset additions in construction projects in the US:

Investments in infrastructure projects

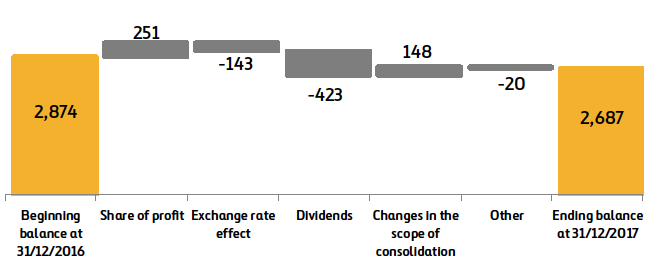

The decrease of EUR 187 million in investments in associates was due largely to the dividends paid amounting to EUR 423 million, mainly by HAH and 407 ETR, and to the exchange rate effect, mainly as a result of the fall in the value of the pound sterling and the Canadian dollar (EUR -143 million), partially offset by the share of the profits of those companies (EUR 251 million) and the changes in the scope of consolidation that took place in the year described in Note 1.1.3 (EUR 148 million).

Investment in associates

As regards the changes in goodwill, there was a decrease of EUR -93 million due mainly to the exchange rate effect (EUR -79 million), the impairment of Autema (EUR -29 million), the changes in the scope of consolidation and other effects (mainly in the Services Division) amounting to EUR 15 million.